If you're dreaming of homeownership in Michigan, this savings account guide will help kickstart your journey. Learn how to save smart and own your dream home. Michigan offers several savings account options specifically designed to assist potential homebuyers in reaching their homeownership goals. With a positive outlook and a few smart saving strategies, you'll be well on your way to making your dream a reality.

One option available to Michigan residents is the Michigan Individual Development Account (IDA) program. This program provides low- to moderate-income individuals with an opportunity to save money and receive matching funds to be used for specific purposes, including purchasing a home. By participating in this program, potential homebuyers can build their savings faster and benefit from the additional assistance offered by the program.

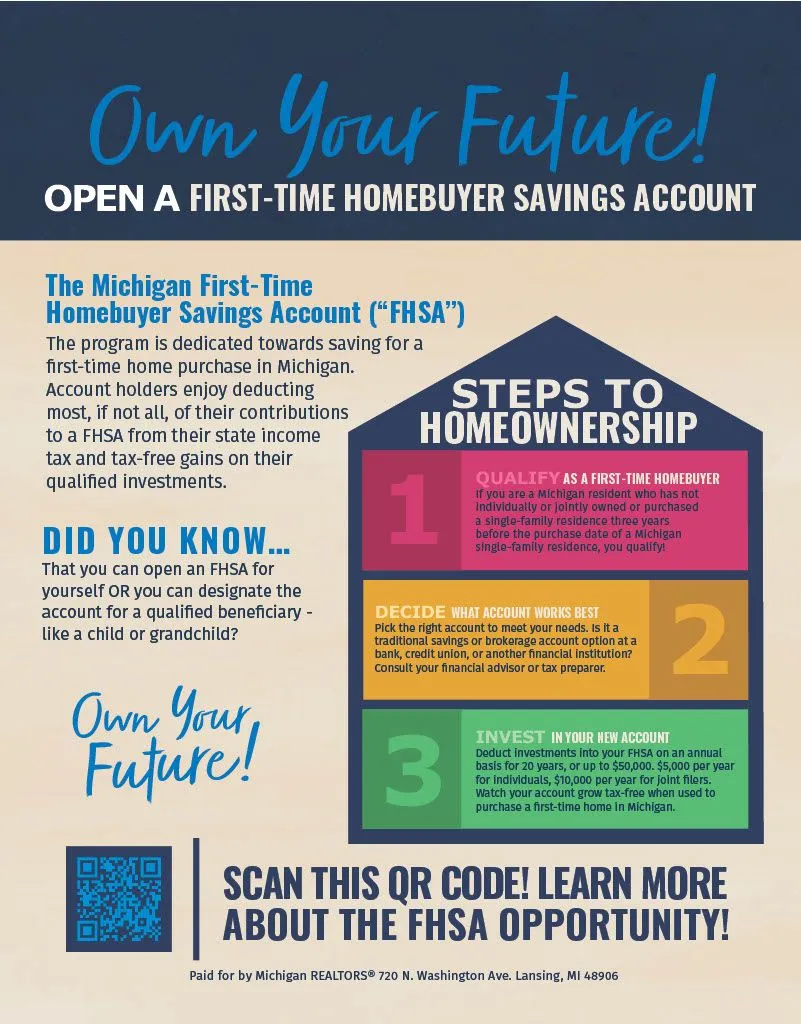

Another option to consider is opening a dedicated savings account solely for the purpose of homeownership. By setting up an account specifically for your down payment and other homeownership expenses, you can track your progress and stay motivated along your journey. Start by setting realistic savings goals and contribute to your account regularly. Over time, even small deposits can add up and bring you closer to your dream of homeownership.

In conclusion, if you're ready to make the leap towards homeownership in Michigan, take advantage of the various savings account options available to you. The Michigan IDA program and dedicated homeownership savings accounts can provide the financial boost you need to achieve your goal. With determination, smart saving strategies, and the necessary guidance, owning your dream home in Michigan is within reach. Let your journey towards homeownership begin today!